Buy and Sell Lava Unlisted Shares Online in India

Saxena Varun 4 min read 25Looking to tap into high-growth opportunities before they hit the stock exchanges? Lava International, a leading Indian mobile handset brand, offers a compelling case for pre-IPO investors. With its innovative product lineup, strong domestic presence, and ambitious global expansion plans, Lava Unlisted Shares are gaining traction in the unlisted market. At Rits Capital, we make it seamless for you to buy and sell these shares online, unlocking exclusive investment potential.

Lava International

“A Leading Force in India’s Mobile Industry”

Have you ever heard of a brand that has established itself in a highly competitive environment, alongside giants like Nokia, Samsung, and others? Lava International is one such brand that has carved out a significant position in the Indian mobile phone sector. Despite facing tough competition from industry leaders, Lava has successfully gained a strong foothold by focusing on affordable smartphones and feature phones, catering to the needs of India’s vast rural and semi-urban populations.

Founded in 2009 by Vishal Sehgal, Hari om sai, Sudhir Kumar, and Shailendra Singh, Lava International Unlisted Shares has proven that with the right management and business model, a homegrown brand can thrive in competitive markets. Operating in over 25 international markets, including South Asia, the Middle East, Africa, and Latin America, Lava has successfully captured a 25% stake in the Indian feature phone market.

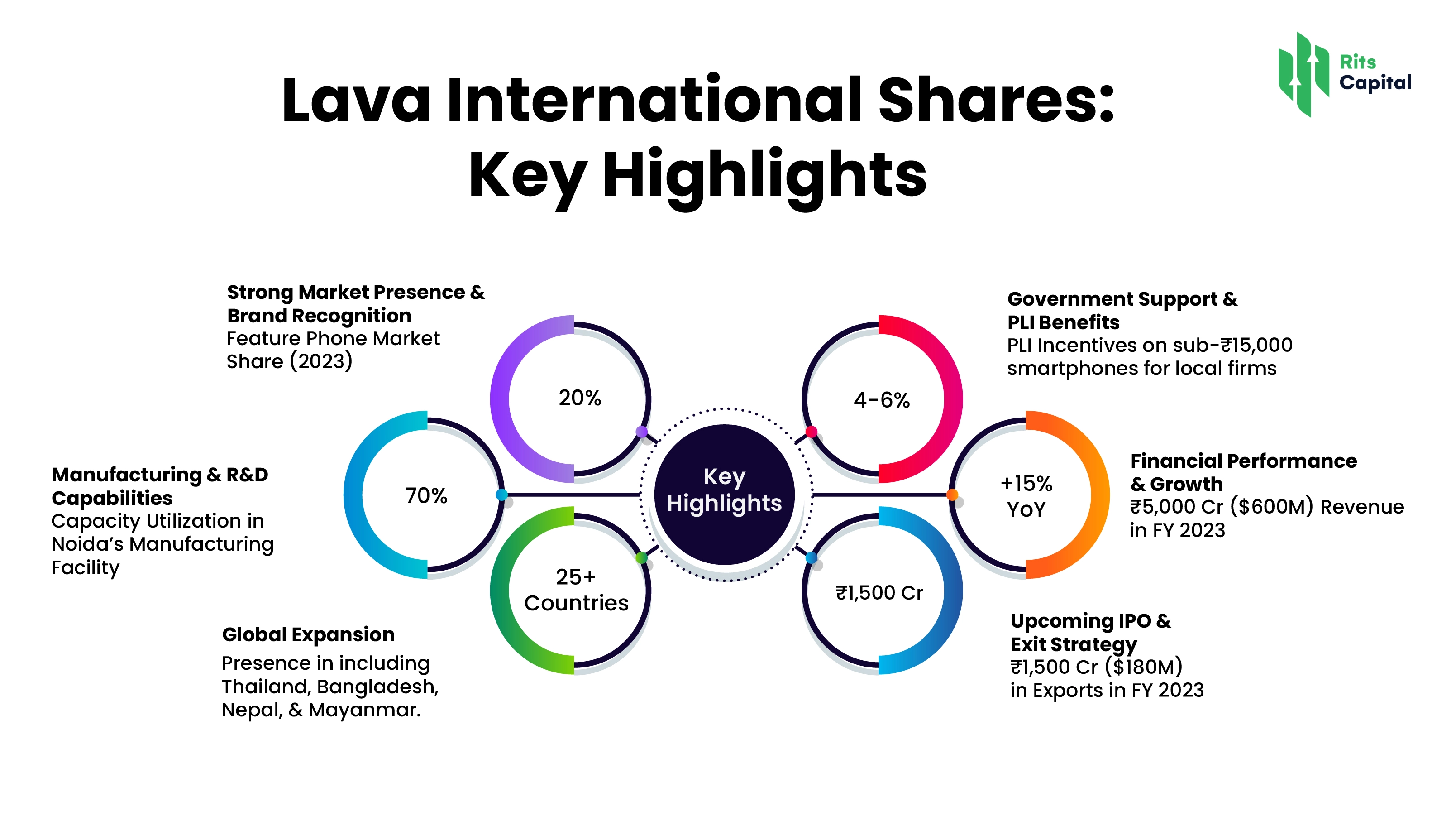

Key Highlights of Lava Internatinol Unlisted Share

Lava International: Growth, Strengths & Future Prospects

- Strong Market Presence & Brand Recognition

- Feature Phone Dominance: 25% market share in 2023.

- Smartphone Expansion: Focus on affordable 5G models to attract young users.

- Brand Strengthening: Investing in marketing and customer engagement to compete with global brands.

- Manufacturing & R&D Capabilities

- Advanced Production Hub: Noida facility with 70% capacity utilization under Make in India.

- R&D Innovation: Dedicated research center for next-gen mobile technologies.

- Localized Supply Chain: Increasing domestic component sourcing to reduce import dependency.

3. Global Expansion

- Presence in 25+ Countries: Strong markets in Thailand (No. 2 feature phone brand) and Latin America.

- Strategic Acquisitions: B Mobile acquisition aiding expansion in emerging markets.

- Export Growth: Leveraging India’s cost advantage to compete globally.

4. Government Support & PLI Benefits

- PLI Scheme Incentives:4-6% subsidy on sub-₹15,000 smartphones, boosting margins.

- Competitive Advantage: Favorable policies for domestic manufacturers over foreign brands.

- Sustained Support: Government incentives aiding long-term growth and expansion.

5. Financial Performance & Growth

- Revenue Surge: ₹5,000 crore ($600M) in FY 2023 (+15% YoY).

- Profitability Boost: ₹250 crore ($30M) net profit, driven by efficiency and PLI benefits.

- Export Success: ₹1,500 crore ($180M) in exports, strengthening global footprint.

6. Upcoming IPO & Exit Strategy

- IPO Plans in Motion: Potential listing to unlock investor value.

- Valuation Growth: Strong financials attracting institutional interest.

- Exit Strategy: Lucrative opportunity for early investors seeking high returns.

With a robust domestic presence, expanding global footprint, and government-backed incentives Lava International is positioned for sustained growth and market leadership..

Financial Highlights (FY 2024) – Competitor Comparison

| Key Metrics | Lava International | Micromax | Samsung India | Xiaomi India |

| Revenue(FY 2024) | ₹3,646 Cr ($437M) | ₹2,800 Cr ($336M) | ₹79,200 Cr ($9.5B) | ₹78,000 Cr ($9.3B) |

| Gross Margins | 21.86% | 19.5% | 22.8% | 20.6% |

| Profit after tax | ₹34 Cr ($4M) | ₹20 Cr ($2.4M) | ₹2,100 Cr ($252M) | ₹1,800 Cr ($216M) |

| Return on equity | 2.78% | 2.4% | 3.5% | 3.2% |

| Debt to equity | 0.23 | 0.30 | 0.18 | 0.22 |

| Net Profit margin | 1.60% | 1.10% | 2.65% | 2.30% |

| Global strength | 25+ Countries | 15+ Countries | 180+ Countries | 100+ Countries |

| Major strength | Strong Local Manufacturing | Comeback Strategy | Premium & Mid-Range Dominance | Affordable Pricing & Online Sales |

How to Buy and Sell Lava Unlisted Shares?

Buying Lava Unlisted Shares

- Find a Trusted Dealer or Platform – Use reputed intermediaries specializing in unlisted shares.

- Check Current Valuation – Lava’s unlisted share price fluctuates based on demand and supply.

- Complete KYC & Payment – Submit PAN, Aadhaar, and bank details, then transfer funds to buy shares.

- Get Delivery of Shares – Shares are credited to your Demat account within T+2 days.

Selling Lava Unlisted Shares

- Find a Buyer or Platform – You can sell through brokers or peer-to-peer deals.

- Negotiate Price & Confirm Trade – Prices depend on Lava’s financials, IPO prospects, and market demand.

- Transfer Shares & Receive Payment – Once the deal is executed, funds are credited to your account.

Key Considerations Before Investing

- Liquidity Risk – Unlisted shares have lower liquidity than listed stocks.

- IPO Potential – If Lava launches an IPO, unlisted investors may get a premium exit.

- Holding Period & Taxation – Holding unlisted shares for 2+ years reduces tax liability on capital gains.

Conclusion

Lava International’s strategic expansion, financial resilience, and government-backed incentives position it as a key player in India’s growing mobile industry. While the company has faced revenue fluctuations, its strong gross margin improvements and future IPO plans indicate a promising growth trajectory. As it continues to innovate and scale, Lava Unlisted Shares remains a high-potential investment opportunity in the Indian mobile manufacturing ecosystem.

Stay tuned for more updates on Lava International’s IPO and market performance.