What is NSE India Ltd. Unlisted Shares | Comprehensive Guide

Saxena Varun 4 min read 25When most investors think of the National Stock Exchange (NSE), they imagine buying and selling stocks like Reliance, TCS, or Infosys. But what if we told you there’s a lesser-known, high-potential segment that savvy investors are eyeing?

Welcome to the world of NSE Unlisted Shares — a gateway to investing in the future giants before they go public.

What Are NSE Unlisted Shares?

NSE unlisted shares refer to the equity shares of National Stock Exchange of India Limited that are not yet listed on any public stock exchange (like NSE or BSE) for trading. Despite being India’s largest exchange by volume and among the top in the world, NSE itself remains a privately held company.

These shares are bought and sold in the private market, also known as the unlisted or Pre-IPO market. Investing in such shares means you’re getting access before the IPO, often at a much lower valuation.

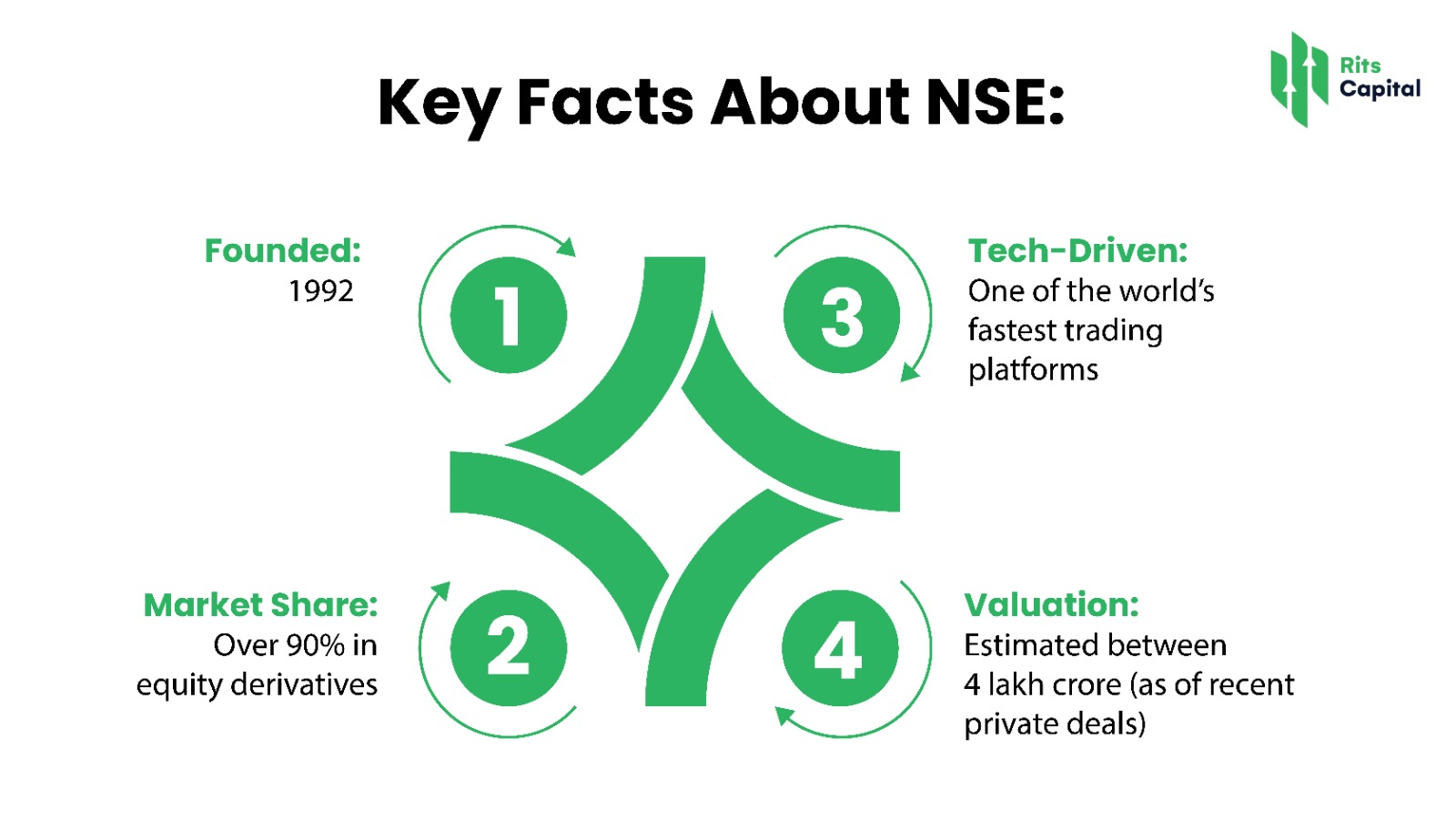

A Glimpse at NSE: Why It Matters

The National Stock Exchange isn’t just another company. It’s the backbone of India’s capital market, offering trading in equities, derivatives, debt instruments, ETFs, and more.

With its dominance in the Indian market and consistent profitability, the Unlisted Shares of NSE are in high demand among institutional and savvy retail investors.

Why Invest in NSE Unlisted Shares?

There are various reasons that one should invest in NSE unlisted share:-

1. First-Mover Advantage

Buying NSE Shares before its IPO can offer significant upside. Investors who got into companies like IRCTC or LIC before listing saw strong returns post-IPO.

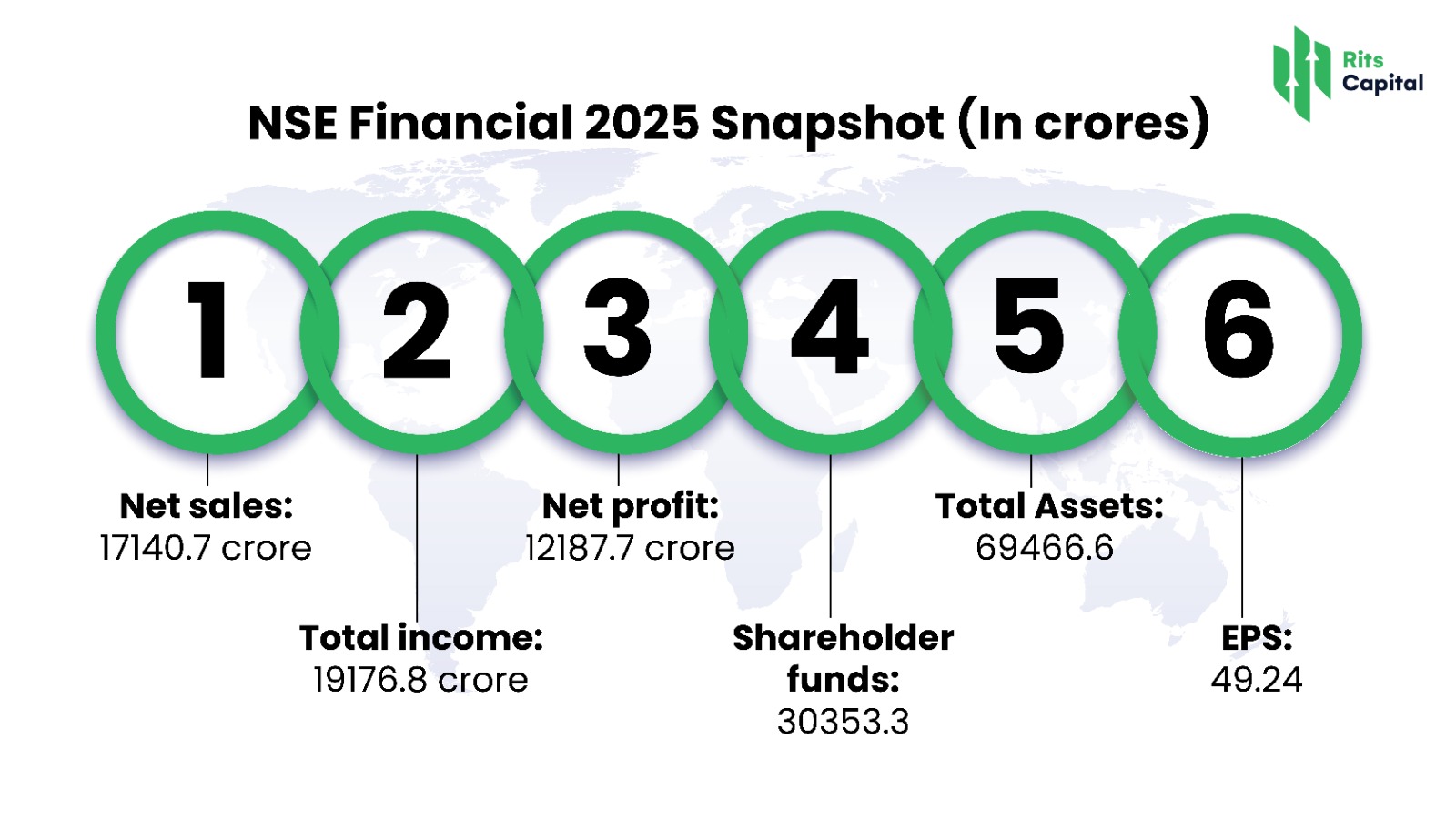

2. Consistent Growth

NSE has shown strong financial performance year-on-year. As India’s financial markets expand, so does NSE’s business potential.

3. Scarcity Premium

NSE unlisted shares are limited in supply. This scarcity can drive up demand — and price — before an IPO.

4. IPO Buzz

There’s strong speculation that NSE will go public in the near future. Pre-IPO investing allows you to ride the IPO wave early.

5. Stable Business Model

NSE earns from transaction fees, data services, listing fees, and more — a diversified and stable revenue stream.

How to Buy NSE Unlisted Shares?

Unlike listed stocks, NSE unlisted shares aren’t available on public platforms. Here’s where Rits Capital comes in.

The Rits Capital Advantage:

- Access to exclusive Pre-IPO shares

- Verified sellers & transparent pricing

- End-to-end transaction support

- Insights on valuations, risks & IPO timelines

We help investors — retail and HNIs alike — gain exposure to NSE Unlisted Shares with confidence and clarity.

Final Thoughts: NSE Unlisted Share – A Rare Gem

NSE’s unlisted shares offer a rare opportunity to invest in India’s most powerful financial institution before it enters the public market.

At Rits Capital, we believe in giving investors early access to tomorrow’s leaders.

Whether you’re looking to diversify, grow wealth, or tap into future IPO gains — NSE unlisted shares deserve a place in your portfolio.

For more information related to unlisted share, kindly visit our page of Unlisted Share .

FAQ’s

Q 1: What is the price of an NSE unlisted share in the Grey market?

Ans: Rits capital offers the best price for NSE unlisted shares at Rs. 1650/-.

Q 2: Why are NSE Unlisted shares falling?

Ans: NSE shares are falling due to various factors such as: Broader market correction,

Q 3: Where to buy NSE Unlisted Shares?

Ans: You can buy NSE Unlisted shares from Rits Capital. They offer the best value and 24/7 support.

Q 4: What is the delivery time of NSE unlisted shares?

Ans: The delivery time of NSE unlisted shares is 3-5 days.

Q 5: How much have NSE unlisted shares grown over the last year?

Ans: This year only, the NSE share grew by an impressive rate of 71%.

Q 6: What is the minimum investment amount required to invest in NSE shares?

Ans: The Minimum investment to invest in NSE shares is Rs. 1 Lakh.

Q 7: What is the minimum lock-in period of NSE unlisted shares after IPO?

Ans: The Minimum lock-in period of NSE unlisted shares post IPO is 6 months.