Understanding HRA Exemption in the New Tax Regime

Saxena Varun 4 min read 25Introduction

Paying rent in India’s big cities is a fact of life for most working professionals. Fortunately, salaried individuals have a tax benefit to ease this burden—House Rent Allowance (HRA). But since the government introduced the New Tax Regime, many are unsure whether they can still save tax via HRA.

This guide will break it down simply: what HRA is, how it works, and what’s changed under the new rules. Let’s dive in!

Overview of Tax Regimes in India

Old Tax Regime

The Old Tax Regime allowed salaried individuals to claim various deductions and exemptions—like HRA, 80C, 80D, LTA, standard deduction, and more. It offered flexibility but required more documentation.

New Tax Regime

Launched with Budget 2020, the New Tax Regime promised lower tax slabs in exchange for dropping most exemptions and deductions.

Income wise tax rate as per new regime:

| Income Slab | Tax Rate (New Regime) |

| ₹0 – ₹3 lakh | 0% |

| ₹3 – ₹6 lakh | 5% |

| ₹6 – ₹9 lakh | 10% |

| ₹9 – ₹12 lakh | 15% |

| ₹12 – ₹15 lakh | 20% |

| Above ₹15 lakh | 30% |

Note: The new regime is default from FY 2024-25 unless you opt out.

What is HRA Exemption?

HRA is a part of your salary meant to cover your rent. The tax benefit depends on:

- Your Basic Salary

- Actual Rent Paid

- City of Residence (metro or non-metro)

Formula to Calculate HRA Exemption (Old Regime)

The least of the following is exempt:

- Actual HRA received

- 50% of basic salary (metro cities) or 40% (non-metro)

- Rent paid minus 10% of basic salary

Example:

Basic Salary: ₹50,000/month

Rent Paid: ₹20,000/month

HRA Received: ₹18,000/month

(Metro city (Delhi)

Calculation:

- Actual HRA = ₹18,000 × 12 = ₹2,16,000

- 50% of basic = ₹25,000 × 12 = ₹3,00,000

- Excess rent = ₹20,000 – ₹5,000 = ₹15,000 × 12 = ₹1,80,000

HRA Exempt = ₹1,80,000 (least of above)

HRA Exemption in the New Tax Regime

Now here’s the punchline: HRA exemption is NOT available if you opt for the new tax regime.

Why?

Because the new regime removes most exemptions and deductions, including:

- HRA (Section 10(13A))

- LTA

- Standard Deduction (reintroduced only in FY23-24)

- 80C investments

Budget 2023 Update

While ₹50,000 standard deduction was allowed again in the new regime from FY 2023-24, HRA is still excluded.

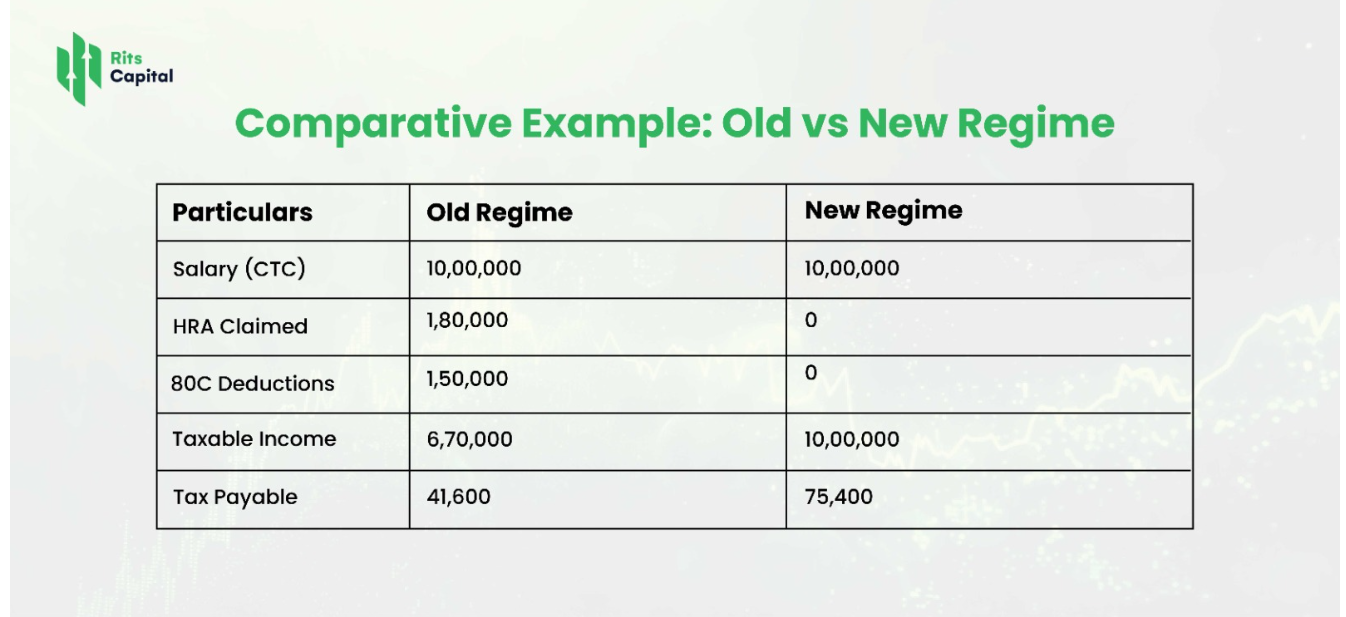

Comparative Example: Old vs New Regime

Takeaway: You save ~₹33,800 under the old regime with HRA and 80C benefits.

HRA If You’re Paying Rent

To claim HRA (in the old regime):

- Submit rent receipts

- Provide landlord’s PAN if rent > ₹1 lakh/year

- Rent to parents? Allowed—if they show rental income

HRA If You’re Not Paying Rent

If you live in your own home or don’t pay rent, you can’t claim HRA, regardless of the regime.

Should You Choose Old or New Tax Regime for HRA?

Stick with Old If:

- You’re paying high rent

- Your HRA is a significant salary component

- You’re claiming multiple deductions (80C, 80D, etc.)

Use Online Calculators

Most ITR portals have comparison tools to help you pick.

Can You Save Tax Without HRA in New Regime?

Yes, but benefits are fewer.

Available Deductions in New Regime:

- Employer NPS Contribution (Sec 80CCD(2))

- EPF/Gratuity

- Standard Deduction (₹50,000 from FY23-24)

When Might New Regime Still Work for You?

- Freshers with minimal investments

- People without rent or loan obligations

- High earners with no time for paperwork

Common Mistakes About HRA & New Regime

- Believing HRA applies automatically

- Not submitting rent receipts

- Forgetting landlord PAN if rent > ₹1 lakh/year

Expert Advice Before Filing ITR

- Confirm your rent structure with HR

- Use income tax calculators

- Don’t forget to opt for the regime when filing

Why the Government Removed HRA Exemption?

- Encourage simpler taxation

- Reduce paperwork

- Plug revenue leakage from fake rent claims

Will HRA Ever Be Allowed in New Regime?

Not for now, but future budgets may re-evaluate based on:

- Taxpayer adoption rate

- Feedback from salaried class

- Pressure to improve middle-class savings

Conclusion

If you live in a rented house and get HRA, the Old Tax Regime is likely more beneficial. The New Regime is great for people with no deductions or investments. Understand your numbers, and choose wisely—HRA can be a game-changer in tax planning!

FAQs

1. Is HRA exemption allowed under the new tax regime?

Ans: No, the new tax regime removes HRA exemption entirely.

2. Can I switch between old and new regimes every year?

Ans: Yes, salaried individuals can switch every financial year.

3. What documents are needed to claim HRA?

Ans: Rent receipts, rental agreement, and PAN of the landlord (if rent exceeds ₹1 lakh per year).

4. What if I pay rent to my parents?

Ans: You can claim HRA, provided your parents show the rent as income in their ITR.

5. Is HRA exemption better than home loan tax benefits?

Ans: Depends on your rent amount vs home loan interest; both can reduce tax under the old regime.