How to Maximize Your Tax Refund on ITR in 2025

Saxena Varun 4 min read 25Filing your Income Tax Return (ITR) isn’t just a legal obligation—it’s an opportunity to reclaim your hard-earned money. For salaried individuals in India, understanding the nuances of tax deductions, exemptions, and recent changes is crucial to Maximize your tax refunds. This guide provides data-driven insights to help you navigate the 2025 tax landscape effectively.

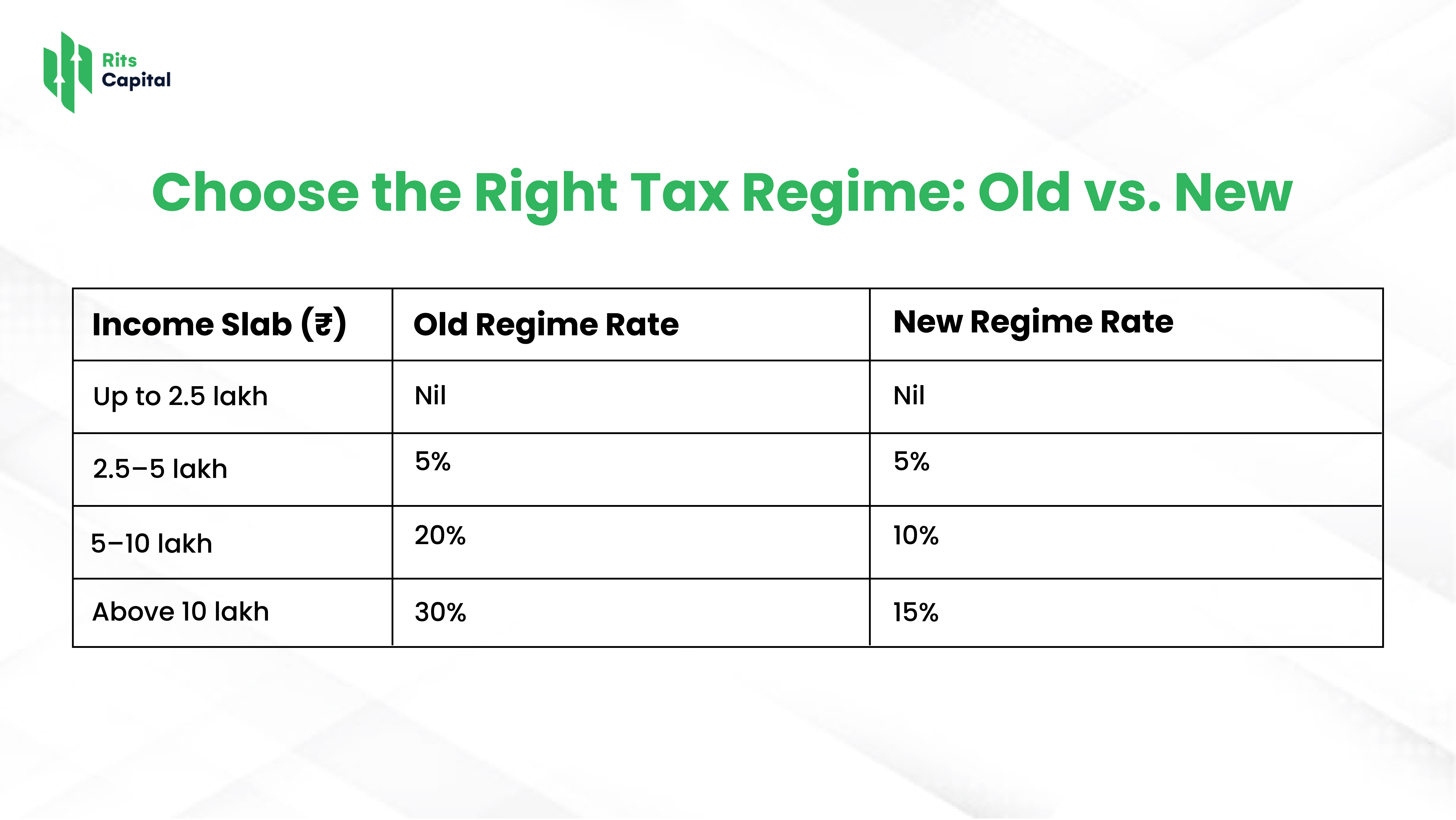

1. Choose the Right Tax Regime: Old vs. New

The choice between the old and new tax regimes significantly impacts your refund potential.

- Old Regime: Offers numerous deductions and exemptions.

- New Regime: Simplified tax slabs with limited deductions.

Tip: If you’ve made significant investments under sections like 80C, 80D, or pay rent, the old regime might be more beneficial.

For a detailed comparison, check out our Tax Planning Strategies for Salaried Individuals.

2. Leverage Section 80C Deductions

Section 80C allows deductions up to ₹1.5 lakh annually. Popular avenues include:

- Public Provident Fund (PPF): Offers an interest rate of 7.1% (as of 2025).

- Employee Provident Fund (EPF): Mandatory for salaried employees, with contributions eligible for deduction.

- Life Insurance Premiums: Premiums paid for policies in your name or your family’s.

- Equity-Linked Saving Scheme (ELSS): Mutual funds with a lock-in period of 3 years.

Example: Investing ₹1.5 lakh in PPF can save you up to ₹45,000 in taxes if you’re in the 30% bracket.

3. Don’t Overlook Section 80D: Health Insurance

Health insurance premiums are deductible under Section 80D:

- Self and Family: Up to ₹25,000.

- Senior Citizen Parents: Additional ₹50,000.

Total Potential Deduction: ₹75,000.

Tip: Ensure you have the policy number and insurer details, as the new ITR forms require specific information for deductions

4. Claim House Rent Allowance (HRA) Wisely

If you live in rented accommodation, HRA can be a significant deduction:

- Required Details:

- Actual HRA received.

- Rent paid.

- Landlord’s PAN (if rent exceeds ₹1 lakh annually).

- City of residence.

Example: For a salary of ₹6 lakh with ₹1.8 lakh annual rent in a metro city, you could claim an HRA exemption of approximately ₹1.2 lakh.

5. Utilize Section 24(b): Home Loan Interest

Interest paid on home loans is deductible up to ₹2 lakh annually under Section 24(b).

Tip: Ensure you have the lender’s details and interest certificate, as these are now mandatory in the ITR forms.

6. File and Verify Your ITR Promptly

Timely filing and verification are crucial:

- Deadline: July 31, 2025.

- Verification: Within 30 days of filing.

Benefits:

- Avoid late fees up to ₹5,000.

- Faster processing and refunds.

- Reduced chances of scrutiny.

Learn more about How to File Your ITR Efficiently.

7. Ensure Accuracy with Form 26AS and AIS

Cross-verify your income and TDS details:

- Form 26AS: Consolidated tax statement.

- Annual Information Statement (AIS): Detailed financial transactions.

Tip: Discrepancies can delay refunds or trigger notices.

8. Maximize Other Deductions

Explore additional deductions:

- Section 80E: Interest on education loans.

- Section 80G: Donations to eligible charities.

- Section 80TTA: Savings account interest up to ₹10,000.

Note: Ensure you have relevant receipts and documentation.

9. Stay Updated with Tax Reforms

The 2025 budget introduced several changes:

- Increased Standard Deduction: Now ₹60,000 for salaried individuals.

- Revised Tax Slabs: Adjustments to benefit middle-income groups.

- Enhanced Digital Filing: Streamlined processes for faster refunds.

Tip: Regularly check official sources or consult a tax professional to stay informed.

- For official updates, visit the Income Tax Department of India.

- For more detailed budget insights, check the Ministry of Finance Budget Portal.

10. Common Mistakes to Avoid

- Missing Deadlines: Leads to penalties and delayed refunds.

- Incorrect Bank Details: Ensure accuracy to receive refunds promptly.

- Ignoring Tax Notices: Respond promptly to avoid complications.

- Overlooking Deductions: Review all eligible deductions before filing.

Conclusion

Maximizing your tax refund requires proactive planning, accurate documentation, and staying informed about the latest tax provisions. By leveraging available deductions and ensuring timely and accurate filing, you can optimize your financial outcomes in the 2025 tax year.

For personalized assistance, consider consulting a tax professional or using reputable online platforms to guide you through the process.