Polymatech Electronics Unlisted Shares: An Overview

Saxena Varun 4 min read 25In the rapidly evolving landscape of India’s semiconductor industry, Polymatech Electronics Pvt Ltd stands out as a pioneering force. As the nation’s first opto-semiconductor chip manufacturer, the company offers investors a unique opportunity to participate in a high-growth sector through its unlisted shares.

What Are Unlisted Shares, and Why Polymatech?

First things first, let’s talk about unlisted shares. These are shares of companies that aren’t traded on public stock exchanges like the NSE or BSE. They’re often called pre-IPO shares because many of these companies are on the path to going public. Investing in unlisted shares can be a bit like finding a diamond in the rough—it comes with risks, but the rewards can be significant if you pick the right company.

That’s where Polymatech Electronics Pvt Ltd comes in. Founded in 2007, this Chennai-based company has carved a niche for itself as India’s first opto-semiconductor chip manufacturer. I first heard about Polymatech while researching the semiconductor industry, which is booming thanks to the global demand for electronics, 5G, and IoT devices. What caught my eye was their focus on innovation and their ambitious growth plans. But before we get too excited, let’s break down what Polymatech is all about and why its unlisted shares are creating a buzz.

Company Overview

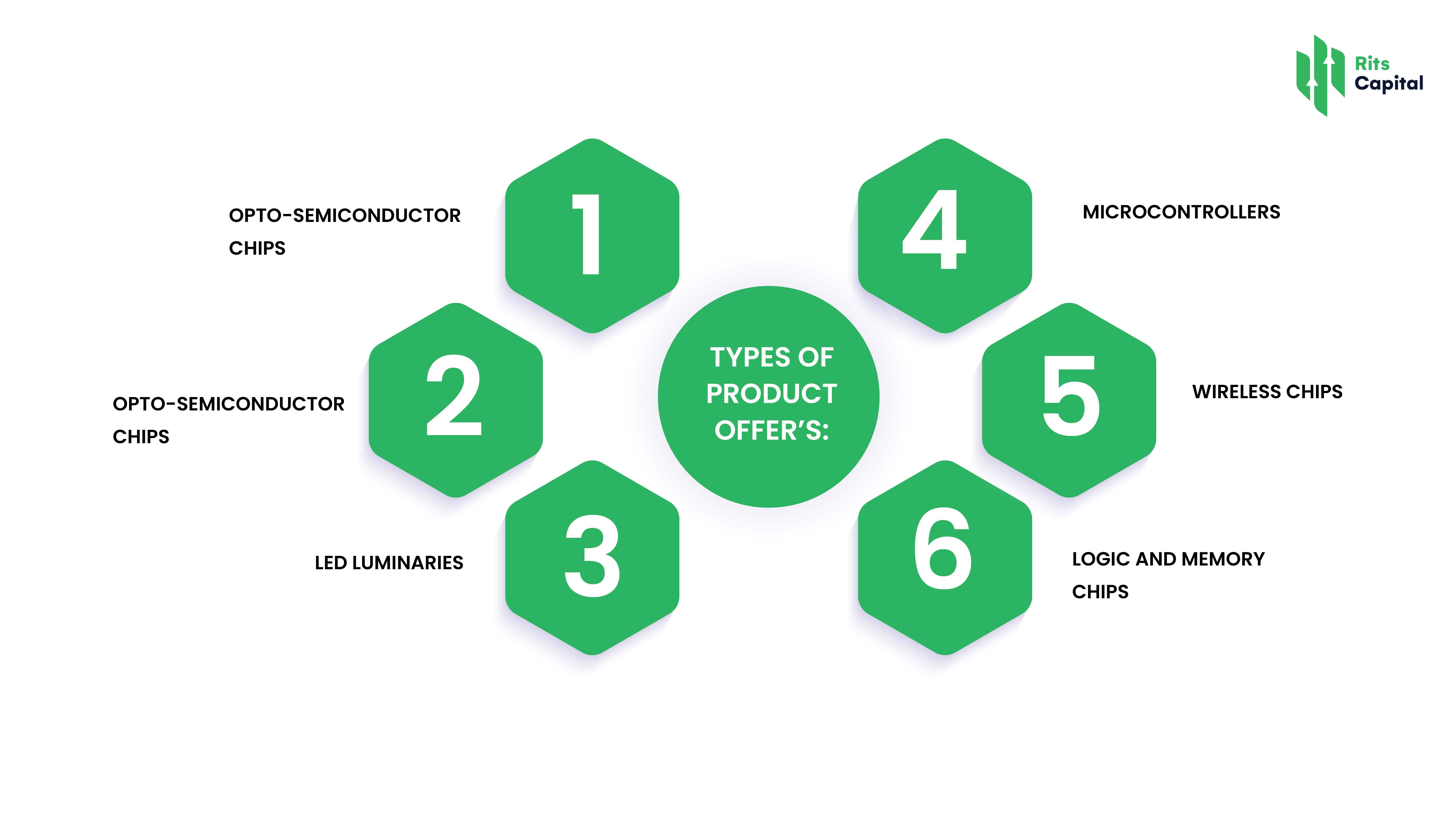

Established in 2007, Polymatech Electronics Pvt Ltd has leveraged advanced European and Japanese technologies to produce a diverse range of products, including:

Financial Performance

Investment Highlights

1. High Volume Potential

Polymatech plans to expand its production capacity from 2 billion to 10 billion chips annually, aiming to meet the growing demand in both domestic and international markets.

2. Low Competition in Unlisted Space

The unlisted shares of Polymatech present a unique investment avenue with relatively low competition. As one of the few players in India’s semiconductor manufacturing sector, the company’s unlisted shares offer early access to a high-growth industry.

3. Strategic Partnerships

In a move to enhance its technological capabilities, Polymatech entered into a strategic alliance with Japan’s Orbray Co Ltd to integrate sapphire singot-growing technologies, essential for advanced semiconductor manufacturing.

Conclusion

Polymatech Electronics Pvt Ltd stands at the cusp of India’s semiconductor revolution. With its robust financials, strategic partnerships, and expansion plans, the company offers a compelling investment opportunity through its unlisted shares. For investors seeking high-volume potential in a low-competition space, Polymatech presents a strategic avenue to participate in India’s technological advancement.

FAQ’s:

1. What is the current price of Polymatech’s unlisted shares?

Ans: As of the latest update, Polymatech’s unlisted shares are trading at approximately ₹112.7 per share. Prices may vary based on market demand and supply.

2. Is investing in unlisted shares legal in India?

Ans: Yes, trading in unlisted shares is legal in India. Transactions occur in the over-the-counter (OTC) market through various platforms like Unlisted Zone and Sharescart.

3. What are the risks associated with investing in unlisted shares?

Ans: Investing in unlisted shares carries risks such as lower liquidity, limited regulatory oversight, and potential valuation challenges. It’s essential to conduct thorough due diligence before investing.

4. How can I sell my Polymatech unlisted shares?

Ans: You can sell your shares through platforms like Sharescart, which facilitate finding buyers and managing the transaction process. Rits capital.

5. What is the expected timeline for Polymatech’s IPO?

Ans: Polymatech has filed for an IPO aiming to raise ₹1,500 crore to expand its manufacturing capacity. While the exact timeline is subject to regulatory approvals, investors should stay updated through official announcements.