Tata Capital Unlisted Shares: India’s Financial Powerhouse Before the Spotlight

Saxena Varun 4 min read 25As India’s economy continues its growth march, few names resonate with as much trust and heritage as the Tata Group. Among its many ventures, Tata Capital Ltd. stands out as a leading financial services institution with ambitions that stretch far beyond traditional lending. For investors eyeing the unlisted share market, Tata Capital unlisted shares represent a rare opportunity to own a piece of India’s next big IPO story.

What is Tata Capital?

Tata Capital Ltd., a subsidiary of Tata Sons, was founded in 2007. It operates across a broad spectrum of financial services:

- Retail and commercial lending

- Wealth management

- Investment banking

- Infrastructure finance

- Private equity and treasury advisory

As of FY2023, Tata Capital managed assets worth over ₹1.5 lakh crore, making it one of India’s top NBFCs (Non-Banking Financial Companies). Backed by the legacy of the Tata Group, its credit rating and market perception remain exceptionally strong, positioning it as a solid alternative to traditional banks.

Learn about Non-Banking Financial Companies on Wikipedia.

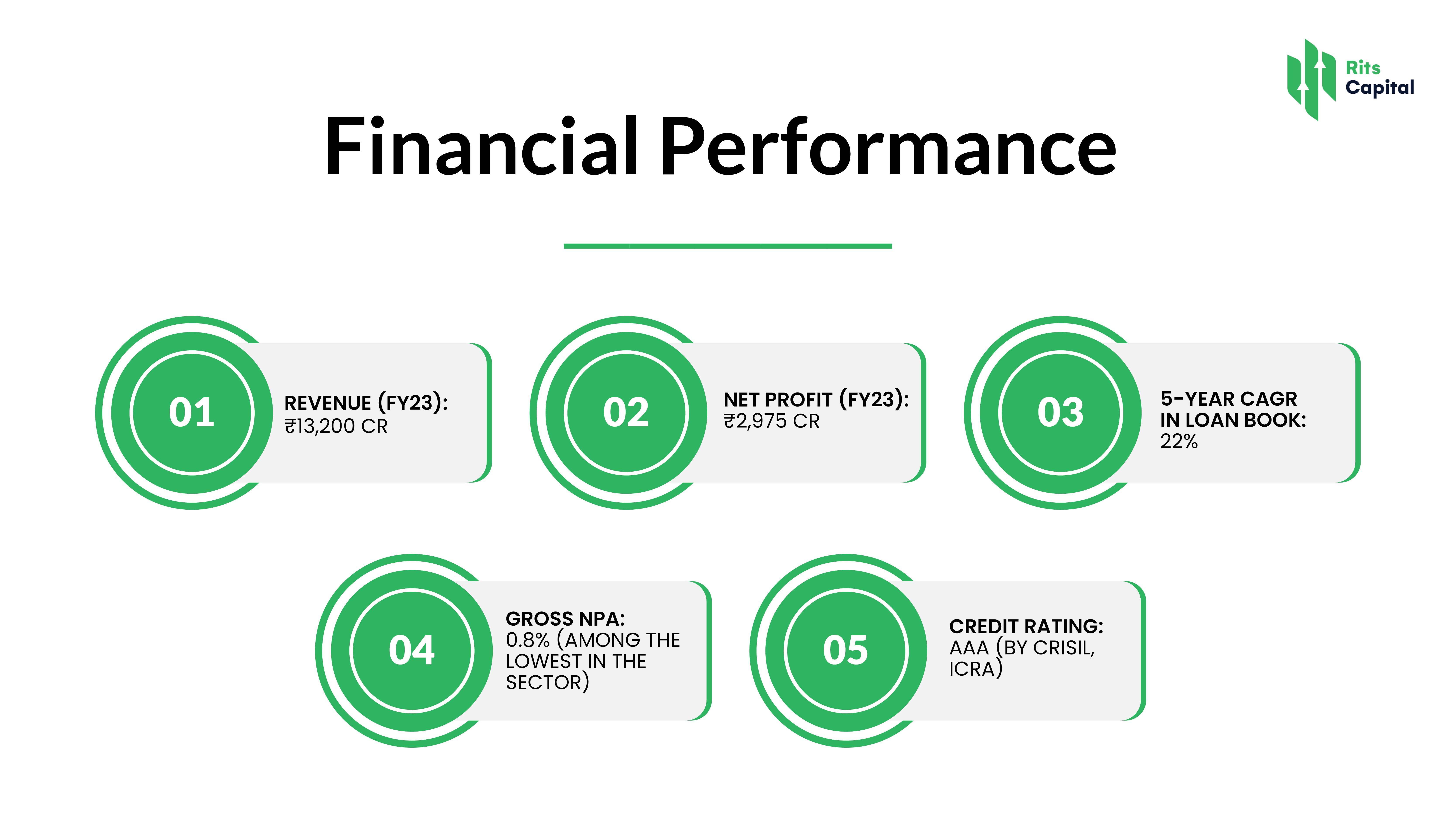

Financial Performance

Tata Capital has displayed consistent growth and resilience, even in volatile market conditions. Here’s a snapshot of its recent performance:

The company operates with excellent asset quality, diversified portfolios, and a growing focus on digital lending. Its financial discipline and risk management practices have consistently delivered value to stakeholders.

Moreover, Tata Capital’s digital transformation is yielding impressive results—approximately 65% of its personal loans in FY23 were disbursed through digital channels. This tech-led shift enhances scalability and reduces customer acquisition costs, contributing positively to profitability.

Why Consider Tata Capital Unlisted Shares?

Tata Capital unlisted equity is drawing interest for several strategic reasons:

- IPO Potential: Tata Sons is considering listing Tata Capital by 2025–26 to unlock value.

- High brand equity: The Tata name is synonymous with trust, governance, and scale.

- Consistent profitability: Strong earnings growth and operational efficiency.

- Diversification: Access to corporate lending, personal loans, SME finance, and fintech innovations.

- Scalability: Growing faster than many listed NBFCs.

- Stable Leadership: Veteran leadership ensures prudent decision-making.

Discover more potential investments at Unlisted Market Insights on Rits Capital.

Recent Buzz

With market discussions around a valuation north of ₹75,000 crore, Tata Capital’s IPO is set to be one of the largest in India’s NBFC history. The firm is also:

- Expanding fintech partnerships

- Strengthening digital loan origination and servicing platforms

- Diversifying into green finance and ESG-compliant products

Its strategy includes increasing its footprint in tier 2 and tier 3 cities, which are underserved by traditional banks. Additionally, the company is integrating AI-driven credit models to improve underwriting and reduce NPAs.

These moves not only broaden its market reach but also align with modern investor themes. Tata Capital is becoming a tech-enabled NBFC poised for long-term growth.

Want to better understand IPOs? Check out this guide on Investopedia.

Final Thoughts

Tata Capital unlisted shares offer an extraordinary window into India’s evolving financial sector—before the spotlight hits. If you’re aiming to diversify your portfolio with high-growth, blue-chip quality assets, this opportunity checks all the right boxes.

At Rits Capital, we help investors access and evaluate these high-potential pre-IPO investments with insight and diligence. Tata Capital is more than just an NBFC—it is the future of how finance will be delivered in India.

Whether you’re a seasoned investor or a savvy first-timer, adding Tata Capital to your unlisted share portfolio could yield significant returns in the medium to long term.

Want to stay ahead in India’s private market revolution? Keep following Rits Capital for updates, insights, and curated opportunities.

FAQ’s:

1. What are Tata Capital unlisted shares?

Ans: These are shares of Tata Capital Ltd. not yet listed on a stock exchange, available via private placements or secondary markets.

2. How do I buy them?

Ans: Through intermediaries, brokers, or platforms like Rits Capital’s Investment Desk, which provides access to curated pre-IPO stocks.

3. What are the risks of investing?

Ans: Risks include low liquidity, valuation uncertainty, and potential delays in IPO timelines. However, the Tata brand offers confidence in governance.

4. What’s the potential upside?

Ans: On listing, investors may see significant value unlocking. Historical listings of Tata group companies have often provided strong post-IPO returns.

5. What happens post-IPO?

Ans: Your unlisted shares convert into publicly traded ones, allowing you to sell them on the stock exchange.