Is Zepto $7-8B Valuation Justified? DCF vs. Peer Multiples Study

Saxena Varun 4 min read 23 Dec 2025Imagine this: Two 19-year-old Stanford dropouts launch Zepto in 2021, and by FY25, they’re clocking ₹11,110 crore in revenue—a whopping 150% jump from ₹4,454 crore the year before. Now, with a $500 million IPO on the horizon at a $7-8 billion valuation, everyone’s asking: Is this quick commerce rocket fueled by real fundamentals or just market hype?

At Rits Capital, we’ve crunched the numbers on Zepto’s path to public markets. This isn’t fluff—it’s a data-driven deep dive using DCF models and peer multiples to help you decide if Zepto deserves a spot in your portfolio. Let’s unpack whether this valuation holds water amid Blinkit and Swiggy Instamart’s fierce rivalry. Buckle up; we’ve got charts, projections, and hard facts ahead.

Zepto’s Hypergrowth Story: The Numbers Don’t Lie

Picture ordering groceries in 10 minutes flat—Zepto’s made that everyday magic possible with 1.7 million daily orders and over 1,000 dark stores. FY25 revenue hit ₹11,110 crore ($1.3 billion), up 150% YoY, powered by $3-4 billion annualized GOV and smarter unit economics. Losses? Halved from FY24’s ₹1,248 crore, with CEO Aadit Palicha claiming 50% cuts in EBITDA burn despite growth.

But here’s the investor hook: Zepto’s sitting on $900 million cash post-$450 million raise led by CalPERS, targeting EBITDA positivity in 12-15 months. They’re expanding moderately—hundreds of new stores, 45,000+ SKUs including high-margin electronics—without the discounting wars that burned peers. Market share? 26%, trailing Blinkit’s 41% but gaining via urban density and AI supply chains.

| Metric | FY24 | FY25 | YoY Growth |

| Revenue | ₹4,454 Cr | ₹11,110 Cr | 149% |

| GOV (Annualized) | ~$1B | $3-4B | 200-300% |

| Daily Orders | ~0.5M | 1.7M | 240% |

| Losses | ₹1,248 Cr | ~₹600 Cr (est.) | -50% |

This table screams execution. But does it justify $7-8B pre-money? Time for valuation math.

To check the latest zepto share price, click here

Peer Multiples: How Zepto Stacks Against Blinkit & Instamart

Quick commerce isn’t isolated—it’s a bloodbath. Blinkit (Zomato) dominates with 41% share, 424M FY25 orders, and projected ₹26,800 Cr sales in FY26 (5x FY25’s ₹5,200 Cr). Swiggy Instamart? 27% share, wider reach (580+ cities), but slower order growth at 286M FY25.

Zepto trades at premium multiples today, but let’s benchmark:

| Company | FY25 Revenue (₹ Cr) | Implied EV (₹ Cr) | EV/Revenue Multiple | FY26 Proj. EV/Revenue | Market Share | Key Edge |

| Zepto | 11,110 | 58,800 ($7B) | 5.3x | 3.2x ($5.5B rev est.) | 26% financials | 10-min delivery, AI supply chain |

| Blinkit | 5,206 | 78,000 ($9.4B, Zomato quick comm. est.) | 15x | 5-6x (₹26,800 Cr proj.) | 41-45% | Scale (2,000+ stores by Dec 2025), AOV ₹709 |

| Instamart | 2,130 | 21,300 ($2.6B, Swiggy quick est.) | 10x | 6.5x (annualized FY25F) | 27% | 580+ cities, megapods (40k SKUs), AOV ₹697 |

At 5.5x FY25 EV/Revenue, Zepto looks reasonable—below Blinkit’s scale premium but above Instamart’s reach play. Peers trade at 20-50x forward sales in growth mode, but Zepto’s urban focus (20 cities, 600+ stores) and profitability pivot could close the gap. If FY26 hits $5.5B revenue as projected, 3x multiple implies $16-20B peak potential—bullish, but execution-risky.

The catch? Blinkit’s AOV jumps to ₹709 (vs. Instamart’s ₹619), highlighting Zepto’s need for non-grocery wins like Zepto Cafe.

AOV= Average Order Value

Wanna know what is consolidated and standalone statement? click here

DCF Deep Dive: Projecting Zepto’s Intrinsic Value

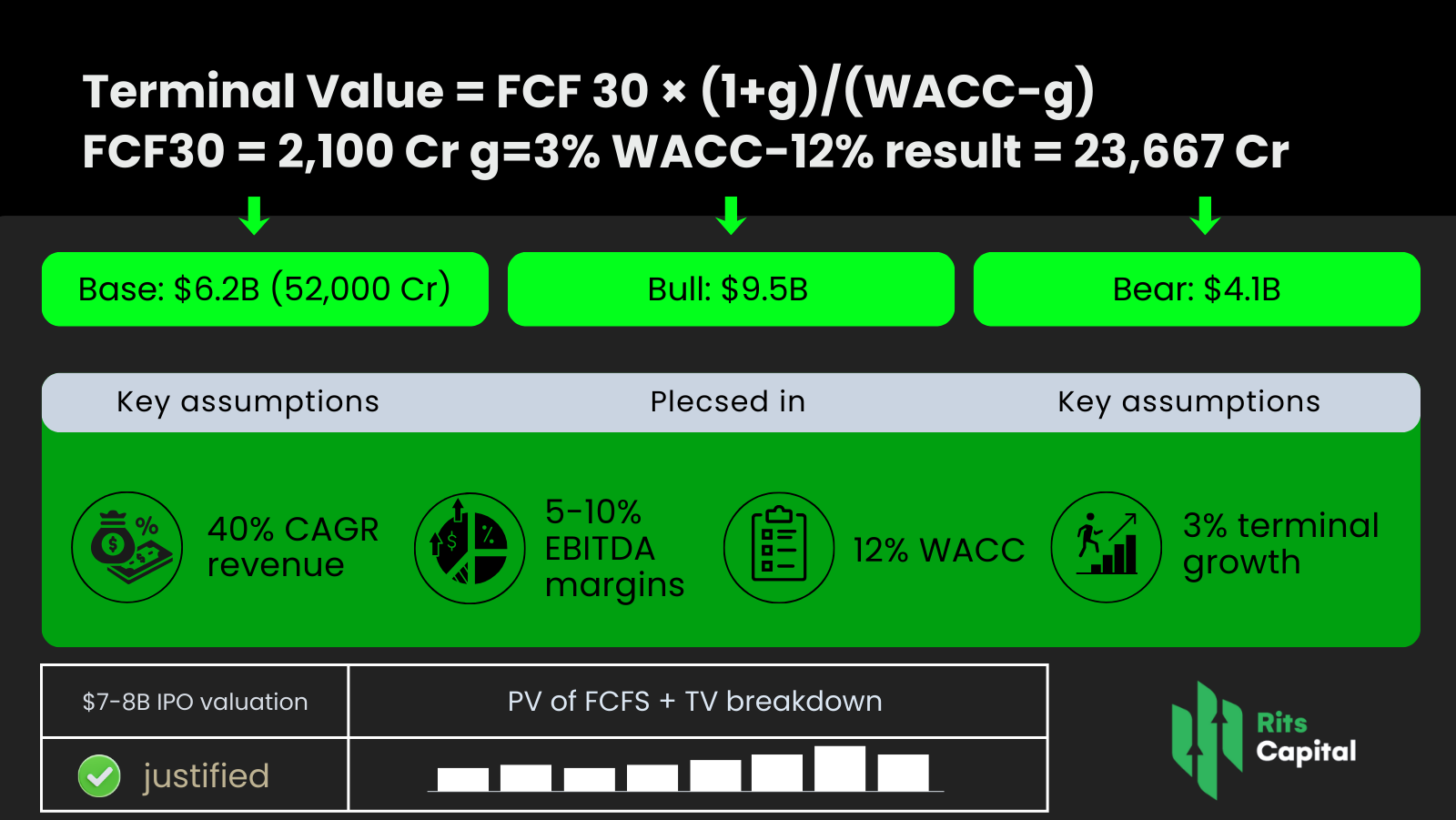

Multiples are quick, but DCF reveals if cash flows justify the hype. We modeled Zepto conservatively: 40% CAGR revenue to FY30 (taming from 150%), margins improving to 5% EBITDA by FY27, 25% tax, 12% WACC (India growth risk), 3% terminal growth.

Key assumptions:

- FY26 Rev: ₹18,000 Cr ($2.2B)

- EBITDA Margin: -5% → 8% by FY28

- Capex: 10% rev (dark stores/AI)

- FCF ramps to ₹2,000 Cr FY30

Risks That Could Derail the Valuation Train

No sugarcoating: Competition is brutal. Blinkit doubles stores to 2,157 by 2026; Zepto must match without cash bleed. Regulatory red flags—FDA suspensions, dark patterns backlash—could spike costs 10-20%. Plus, 2026 IPO crowd (Swiggy echo) risks derating multiples to 3-4x.

Yet upsides shine: 40% Indian ownership push, Motilal Oswal backing, AI edges. At Rits Capital, we see 20-30% upside if they hit EBITDA break-even pre-listing

Investor Playbook: Should You Bet on Zepto?

Verdict? Yes, $7-8B feels justified on DCF base/bull cases and peer parity—but buy the dip post-IPO volatility. Track DRHP for unit truths; allocate 5-10% in diversified quick commerce portfolios via trading platform. Long-term? India’s ₹6,400B quick commerce Total asset management triples by 2028.

Want to Invest in Zepto? Let Rits Capital Guide You.

- Exclusive access to high-potential startups

- Personalized portfolio advice

- Zero hassle, all upside

Contact us now on- 991-1090-800 to get started — spots are limited

Join Our Whatsapp Channel to get the latest Unlisted Shares Prices, Latest News, exclusives, and videos on WhatsApp.

FAQs:

1. When is Zepto IPO date?

Ans: Zepto plans DRHP filing soon, targeting mid-2026 listing with $500M raise (fresh issue + OFS). No official date yet—track SEBI recent updates on website.

2. What is Zepto current valuation?

Ans: $7-8B pre-IPO after $450M raise at $7B. FY25 revenue ₹11,110 Cr justifies 5.3x EV/Revenue vs. peers’ 10-15x.

3. Is Zepto profitable?

Ans: Not yet—FY25 losses ~₹600 Cr (halved from FY24), but EBITDA positive targeted in 12 months via unit economics fixes and $900M cash runway.

4. Zepto vs Blinkit which is better investment?

Ans: Blinkit leads (41% share, 15x multiple), but Zepto’s 26% share + 150% growth offers catch-up potential at cheaper 5.3x. Diversify both post-IPO.

5. Zepto IPO price band?

Ans: Not announced—expect ₹300-400/share based on $7-8B val and 2.5-3B shares outstanding. GMP tracking at 20-30% premium signals hot demand.

6. How to apply for Zepto IPO?

Ans: Use ASBA via Groww, Zerodha, or Upstox. Minimum lot ~₹15,000; aim for HNI quota if oversubscribed 10-20x like Swiggy.

7. Zepto revenue FY25?

Ans: ₹11,110 Cr, up 149% YoY from ₹4,454 Cr. Driven by 1.7M daily orders, $3-4B GOV, and dark store expansion to 1,000+.

8. Zepto market share in quick commerce?

Ans: 26% behind Blinkit’s 41% and Instamart’s 27%. Urban speed edge (10-min delivery) positions for 30%+ by FY26 in $40B TAM.