Best Alternative Investment funds in India 2025

Saxena Varun 4 min read 25The Securities and Exchange Board of India (Alternative Investment Funds) Regulations 2012 were put into effect by the Securities Exchange Board of India (SEBI) on May 21st, 2012. Regulating the private fund pool was the goal.

This section explores the significance and development of various investment opportunities.

What is Alternative Investment funds (AIF’s)?

A privately pooled investment vehicle that combines the capital of both local and foreign investors and allocates it in accordance with the specified investment policy is known as an alternative investment fund. It can be incorporated in India as a corporation, limited liability partnership, body corporate, or trust.

An AIF investment involves three parties. Below is a discussion of each of them.

- Setlor: Creates the trust that functions as an AIF.

- Trustee: Oversees the private fund collection pool.

- Contributer: Investors who make financial contributions to the AIF.

In India and beyond, an AIF makes investments in non-traditional assets such commodities, real estate, hedge funds, and private equity.

For example, the table below provides important information about 360 One Asset1, an AIF.

- Global Presence:

Dispersed over nations like Canada, the United Arab Emirates, Singapore, Mauritius, and India. It makes investments in offshore and onshore assets.

- Portfolio:

Alternative investment funds, mutual funds, and portfolio management services.

Click to know- What is Portfolio management service?

- Target Investers:

Foreign Institutional Investors (FIIs), Ultra High Net Worth Individuals (UHNIs), and High Net Worth Individuals (HNIs)

Click to know: Difference between AIF vs Mutual fund vs PMS

Growth of AIF in India:

Consistent data and facts make the growth of AIF in India clear. Alternative Investment Funds in India grew at 5% on a quarterly basis as of December 2024. As of March 31, 2025, the total obligations amounted to INR 13,49,051 crore.

Factors that contribute growth in India:

- Economic growth: This upward tendency is largely due to the nation’s economic development as measured by its GDP, per capita income, etc.

- Growth in HNIs: HNIs, UHNIs, and FIIs are the main target audience for alternative investing platforms. India has the sixth-highest UHNI population in the world, according to 2024 reports4. Furthermore, it is ranked third in Asia for UHNI population category. The growth of AIFs is directly impacted by the increase in HNI and UHNI populations.

- Regulatory support: Regulators like SEBI and RBI have extended significant support to the AIF ecosystem, aiding the top alternative investment funds in India further. For instance, reports dated 19 May 2025 state the RBI’s proposals to relax investment norms in regulated AIFs5.

The performance of the best alternative investment funds in India is greatly impacted by the growing trends of AIFs and the factors that contribute to them.

India’s Leading Alternative Investment Funds for 2025

There are numerous Alternative Investment Funds (AIFs) available today. Some AIFs do better than others, though, just like with any other investment vehicle. The best alternative investment funds in India as of 2025 are examined in more detail in this section.

Best AIFs in India for 2025

The bulk of Alternative Investment Funds (AIFs) in India have generated positive returns in 2025, indicating their robust performance, despite varying market situations. In April 20256, 110 of the 123 AIF tactics under observation saw gains.

The single-month yields of the top AIFs in India ranged from 5% to 9%. Long-only Category III AIFs performed better than long-short strategies because of the strong economic growth and broad sectoral benefits.

The top five industries with the highest cumulative net investments are listed in the table below.

| Name | One year return(%) | Return since inception(%) |

| A9 Finsight Pvt. Ltd.- Finavenue Growth Fund | 24.87 | 78.38 |

| Knight stone Capital Management LLP- Matterhorn India Fund | 24.62 | 21.72 |

| 360 One Asset Management- High Growth Companies Fund | 24.09 | 37.53 |

| 360 One Asset Management- High Conviction Fund Series 1 | 19.74 | 17.55 |

Categories Of Alternative Investments In India

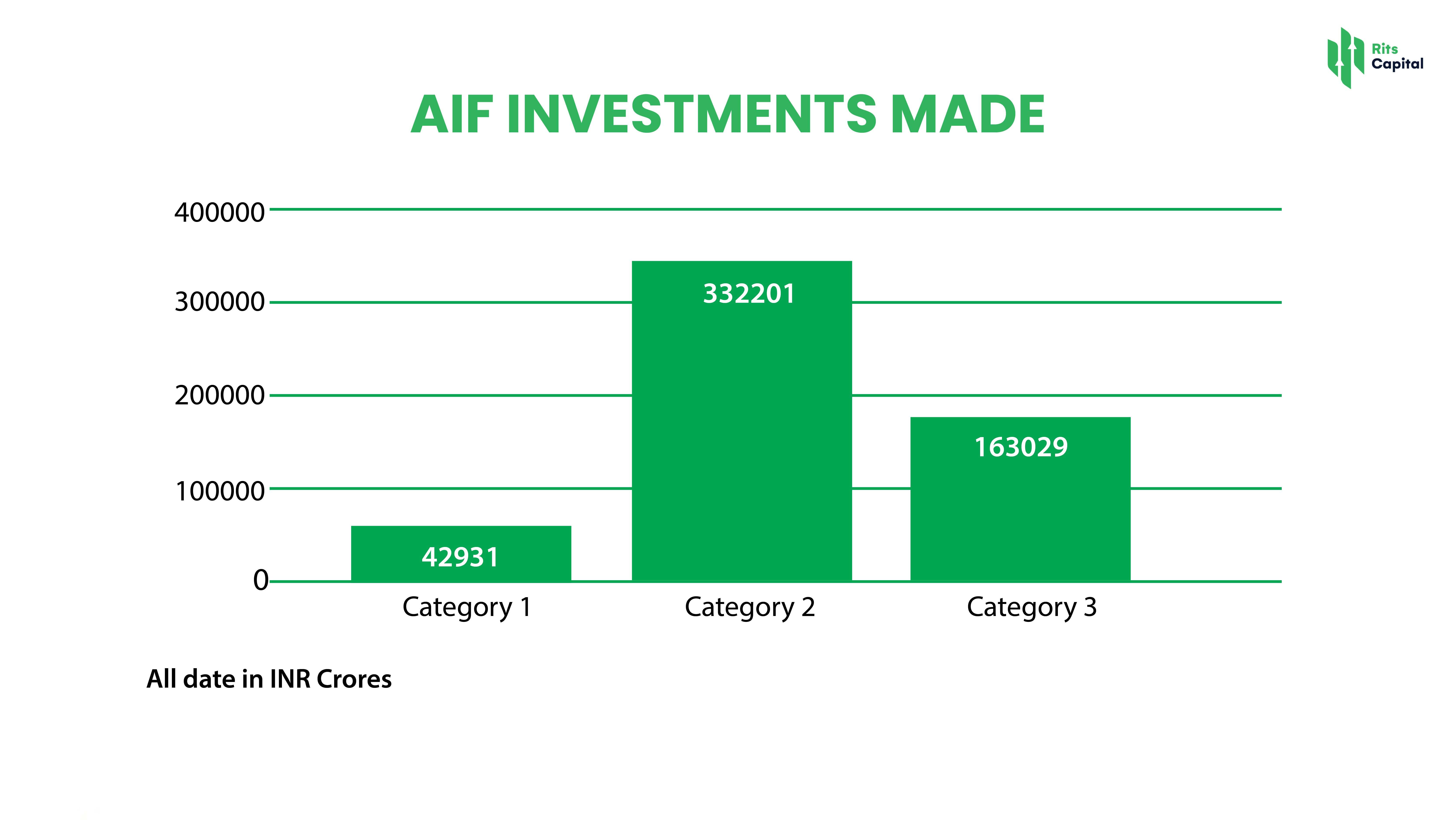

Three AIF categories must be understood in order to compare AIFs as effectively as possible. Therefore, the many AIF categories are mentioned below to make it easier for investors to understand high-return investment funds in India.

- Category I AIFs:

These funds make investments in infrastructure, SMEs, start-ups, early-stage businesses, and social projects that are deemed to have positive social or economic effects. Infrastructure funds, SME funds, and venture capital funds are a few examples.

- Category II AIFs:

Funds that do not fit under Categories I or III, such as debt funds and private equity funds, are included in this category. With the exception of day-to-day operations, they usually steer clear of leverage and concentrate on investments in debt instruments or unlisted businesses.

- Category III AIFs:

To provide short-term profits, these funds employ sophisticated trading techniques like leverage and derivatives. Important examples in this area are hedge funds and specific PIPE (Private Investment in Public Equity) funds.

Final words:

In 2012, SEBI was given regulatory authority over alternative investment funds. These funds are privately pooled and aimed at FIIs, UHNIs, and HNIs. The popularity of AIF is currently rising significantly in the investment scene. Numerous factors, including the growing number of HNIs and economic success, have an impact on this development.

Nevertheless, investing in the best alternative investment funds in India necessitates a careful examination of their return, risk, benchmark comparisons, and other factors. Furthermore, successful investing also requires regulatory compliance.

FAQ’s

Q 1: What are AIFs and why are they gaining traction in 2025?

Ans: AIFs are privately pooled investment vehicles for sophisticated investors, offering exposure to non-traditional assets like private equity, venture capital, and real estate. They’re gaining traction for diversification and potential high returns beyond public markets.

Q2: What types of AIFs are most active in India in 2025?

Ans: Category I AIFs (Venture Capital, Infrastructure Funds) supporting early-stage/growth sectors, and Category II AIFs (Private Equity, Debt Funds) are highly active, reflecting diverse investment strategies.

Q3: What’s the minimum investment for AIFs and are there new regulations in 2025?

Ans: The minimum investment for most AIFs is ₹1 crore. SEBI has refined regulations in 2025, including extended NISM certification deadlines for fund managers and clarified investment strategies for Category II AIFs.